Insights

Looking for a smarter way to manage your money?

Insights is here to help.

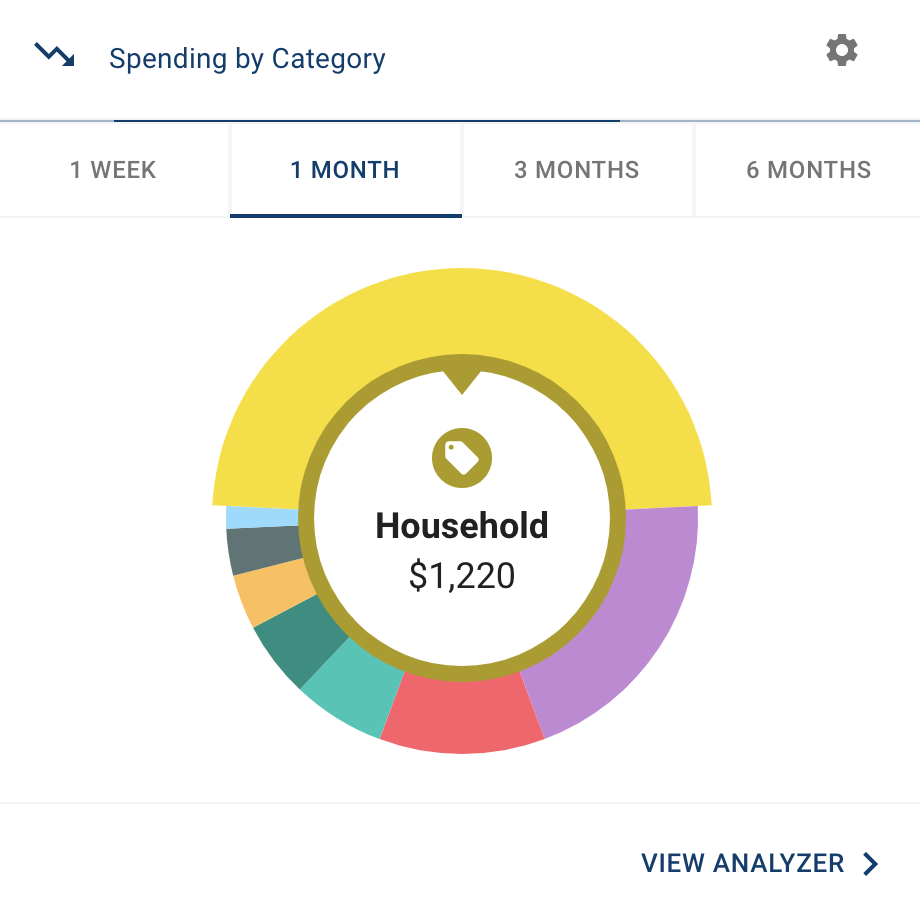

We know that one of the hardest things about personal financial management (PFM) is simply organizing all of the details of your financial life.

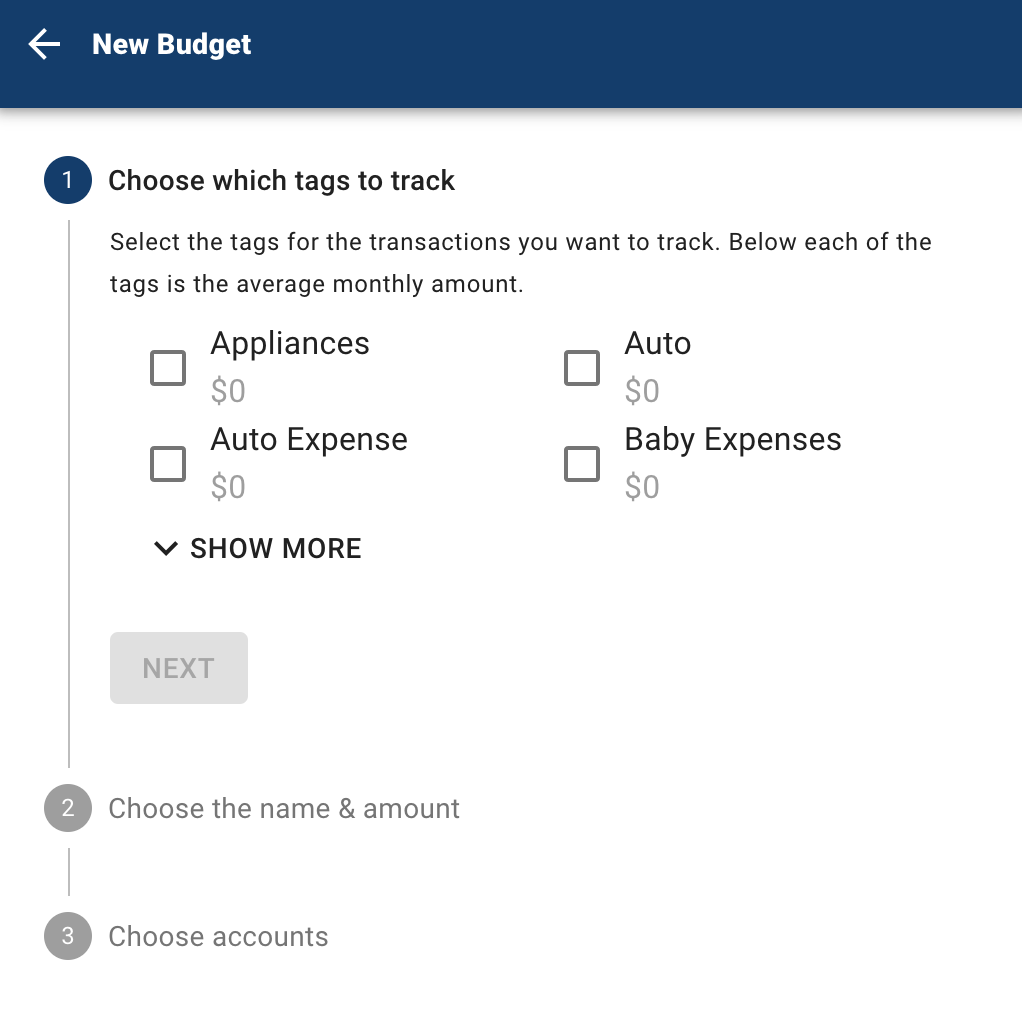

And that’s why Insights is built to make it much easier to understand your spending and gain insights about how your money comes and goes each month.

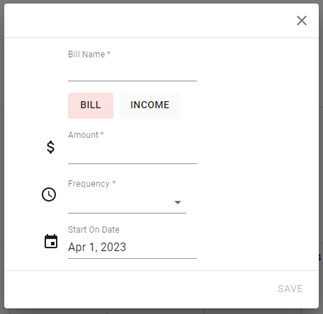

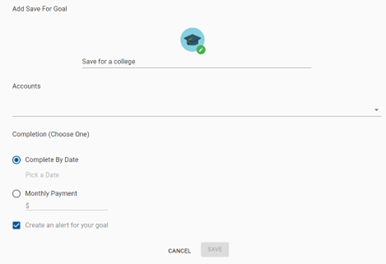

Insights from West Point Bank can help you stay on top of your bills, your cash flow and your entire financial picture, so you can set clear goals and achieve them. Login to your online or mobile banking account and access Insights today.